Medtech in the UK

The UK is home to one of the leading medical technology (MedTech) sectors globally. With renowned institutions that attract top talent from around the world and a long history of pioneering medical breakthroughs, the UK continues to advance in research capabilities, cutting-edge science, and innovative developments.

Overview of the Medtech industry in the UK

The Medical Technology (MedTech) sector covers the developing and/or manufacturing Medtech products, like single-use consumables to complex hospital equipment, tools and digital health. In the UK, in 2020, the MedTech sector comprises approximately 4,140 businesses employing 138,100 individuals, generating a turnover of £27.6 billion. The largest core segments by turnover are single-use technology, digital health, and in vitro diagnostics, which collectively account for 27% of the sector’s total turnover. In terms of employment, the largest core segments are digital health, single-use technology, and in vitro diagnostics, representing 32% of the sector’s workforce.

The growing demand for medtech in the UK has been rising for a number of reasons, with the ideal impacts on reduced costs and better healthcare results.

The UK population, which was 66.4 million in 2020, is projected to reach 72.4 million by 2043, with approximately 3 million individuals aged 85 and over. This demographic shift, particularly the growing proportion of older individuals, will undoubtedly increase the demand for medical support. In addition, the prevalence of chronic conditions is rising, with around 26 million people in England living with at least one chronic condition, such as diabetes, asthma, and COPD, according to the NHS.

The UK is also spending more on healthcare expenditure. In the UK, the total current healthcare spending made up 12.0% of GDP in 2020, up from 9.9% in 2019, with the NHS spending roughly £10 billion a year on medtech (DHSC Estimate). Ongoing advancements in IT and communications technologies have led to a high level of product innovation. Improved understanding of disease causes, such as cancer, is driving new developments in medical technology for prevention and treatment. Consequently, broader progress in medical research is contributing to the emergence of new MedTech solutions. In 2021, the UK submitted 1 in 12 of all patents to the European Patent Office, including 471 medical technology patent applications.

The UK MedTech industry faces several challenges, including reduced healthcare spending during and after the Covid-19 pandemic, a shortage of STEM graduates, increased regulatory requirements, and uncertainty in the US MedTech market, which particularly affects MedTech manufacturing. Additionally, market conditions remain unclear due to the impact of Brexit.

Opportunities in the UK Medtech sector

With a rise in demand for wearable technology, telemedicine, and integrated artificial intelligence (AI) in medical equipment, the Covid-19 epidemic has sped up innovation in the sector. The wearable device industry was worth roughly $27 billion in 2019 and is anticipated to expand to $64 billion by 2024. This year, the AI market is forecast to achieve sales of $93 billion, up 12% from 2022. The telehealth industry was estimated to be worth $2.17 billion in 2022. According to experts, medical technology sales are anticipated to reach $644 billion by 2026, offering the sector substantial prospects. With exports of more than £6.4 billion, the UK has established a reputation for fostering innovation across the world. Following Covid, the industry saw a rise in demand for better diagnostics, remote patient monitoring, and digital healthcare technologies.

Supports for the UK Medtech growth

The UK MedTech sector benefits from substantial support across both the public and private sectors. To sustain the UK’s position as a global science leader, attract high-value investment, and drive job creation nationwide, the government is committed to supporting ambitious and innovative MedTech research. In 2019, the UK government allocated £2.7 billion to health research and development, representing over 20% of the national R&D budget. Among OECD nations, the UK ranks second only to the United States in both total and per-capita investment in health research. Also, around 60 distinct research initiatives promoting cutting-edge technologies existed in 2021, totaling more than £1 billion in financing. In addition, the inaugural round of Life Sciences Innovative Manufacturing Fund (LSIMF) funding will benefit four life sciences businesses from around the UK. The funding and advancement of life sciences manufacturing initiatives for both medical diagnostics and human medications would be assisted by £277 million.

The government also aims to enhance NHS performance with updated technology that will enable speedier diagnosis, treatment, and eventually discharge to free up hospital beds, while increasing the availability of the finest equipment to offer more resilience to health care issues, such as pandemics. In addition, building on the Life Sciences Vision, the NHS, the National Institute for Health and Care Excellence, and the Medicines and Healthcare products Regulatory Agency should work together more effectively as an innovation partner to ensure that patients can access the correct goods safely.

The medical device sector in the UK

The UK is home to numerous leading medical device manufacturers, recognised for their advanced technologies, highly skilled expertise, and extensive industry experience. It represents the third-largest medical device market in Europe and the sixth-largest globally. In 2020, the UK medical device sector was valued at over €17 billion, following France (€31 billion) and Germany (€41 billion). The UK also ranks among the top five European countries for in vitro diagnostics (IVD), alongside Germany, France, Italy, and Spain. The UK’s strong and expanding presence in the global medical device industry is further reinforced by Europe’s significant share of the global market—accounting for 27.6% and valued at approximately €140 billion—second only to the United States.

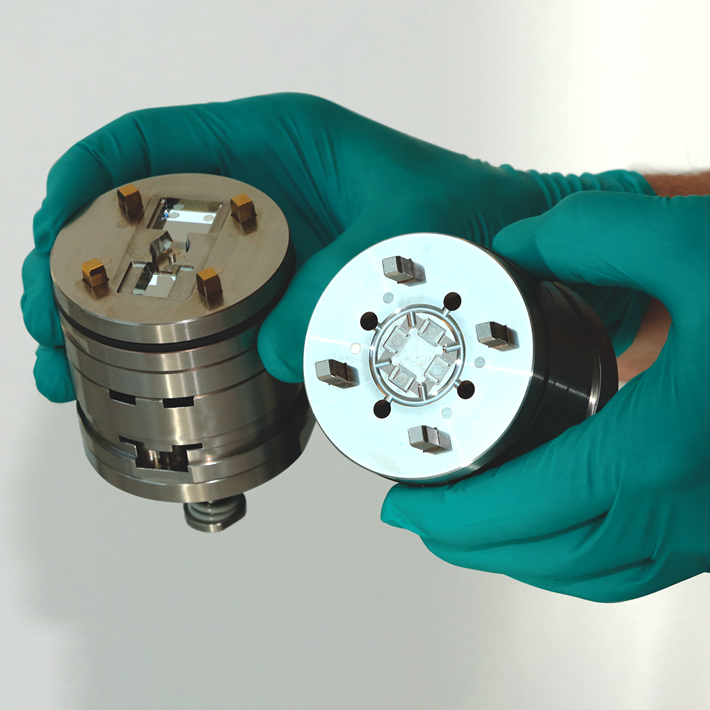

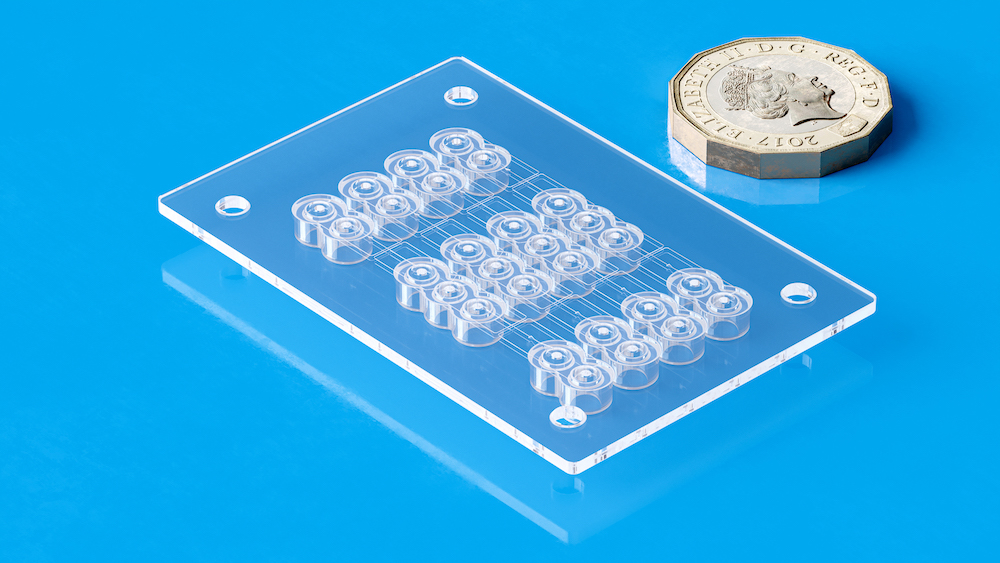

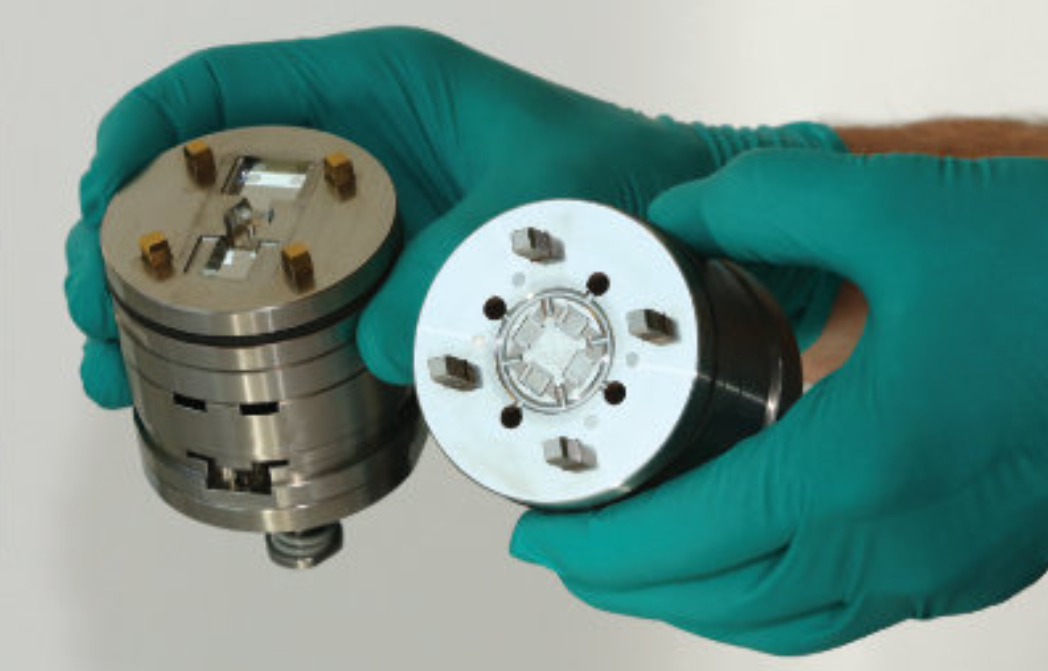

Established in 2003, Micro Systems UK is a leading manufacturer in precision-engineered injection medical moulds and micro-moulds. We design mould tools for medical devices such as drug delivery inhalers, pens and injectables, microfluidic diagnostic chips (lab on a chip), intraocular lenses (IOL) and moulded implantable parts. Micro Systems offers innovative solutions for designing and manufacturing multi-cavity, high-volume moulds. We are ISO 9001 and ISO 13485 certified, and can meet all of your specific medical mould and moulding requirements. Contact us today!